If important, consider methods to improve your credit score. In case your rating falls under 610 or you need to Raise your score to receive the ideal terms doable, just take the perfect time to enhance your credit history score just before making use of, for instance lowering your credit history use or spending off unpaid debts.

Explore is a web based lender that also offers shoppers charge cards, retirement answers and personal loans in all 50 states. As being a lending System, Discover stands out because of its on the net software and mobile banking instruments, very well-reviewed consumer help team and speedy funding.

Also check for costs, such as loan origination charges, prepayment penalties, application charges and late costs. Though the charges may possibly look small, they are able to increase up and consume into the value within your loan so go through every single phrase from the fine print before you decide to indicator to the dotted line.

Upstart has designed a mark on the private loan Area because of its synthetic intelligence- and equipment Understanding-primarily based method of borrower qualification. In actual fact, Upstart estimates that it's been in the position to approve 27% far more borrowers than possible beneath a traditional lending model.

We also preserve a different list of initial-time household buyer tips and concerns worthy of trying out. Should your question doesn’t look On this list, make use of the chatbox and inquire us Reside. What modified With all the Downpayment Towards Equity Act of 2023 through the Downpayment Towards Equity Act of 2021? The 2023 version with the Downpayment Toward Equity Act simplifies the definitions of very first-time dwelling purchaser and first-generation dwelling purchaser, and proposes a necessity-primarily based allocation of money grants to states.

When looking for the top on the internet personal loans, stay with lenders which have a superb standing and offer aggressive charges. Make the most of online prequalifications, considering the fact that these Permit you to compare loan offers without the need of harming your credit history score.

Comparable to a HELOC, a house fairness loan permits you to borrow hard cash based on your property fairness. This type of loan provides the complete amount of money unexpectedly. You pay it back in established payments similar to a mortgage.

Even so, in the event you’re thinking of a debt consolidating loan from SoFi, Take into account that the lender won't present immediate payment to a borrower’s other creditors. This means the loan proceeds will be deposited to the checking account and you’ll need to pay off your other lenders individually.

Loans with shorter phrases have more substantial month to month payments but considerably less desire All round. For a longer period phrase loans, nonetheless, give smaller regular payments at the price of extra interest paid around the everyday living of one's loan.

Then, set up automated payments so that you don’t miss out on any of your loan payments. Last but not least, double Examine that the lender is obtaining your payments soon after the 1st withdrawal.

WASHINGTON — (AP) — Us residents who will be struggling to repay federal scholar loans since of monetary hardship could get some of their financial debt canceled below President Joe Biden's most recent proposal for popular loan forgiveness.

And, if a lender expenses an origination rate, learn no matter whether it’s created into the APR or taken out in the loan amount of money before funding, as this will likely influence the loan quantity you'll want to ask for.

A house fairness line of here credit history (HELOC) is really a form of revolving credit score — similar to a credit card — which you could submit an application for according to the equity with your loan. You can shell out up to your Restrict, pay it down, after which commit it yet again during the draw period of your loan, producing this adaptable for predicted but unfamiliar bills.

There's two most important drawbacks to LendingPoint: significant optimum APRs and origination costs. When you can ordinarily steer clear of substantial APRs by retaining a very good credit rating score, LendingPoint origination charges (around 10%) rely on the state you reside in.

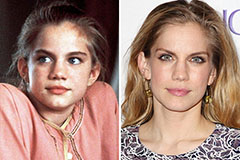

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jaclyn Smith Then & Now!

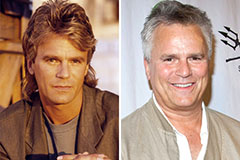

Jaclyn Smith Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!